Discover America's Hidden Gems: Free RV Camping Expertise at Your Fingertips

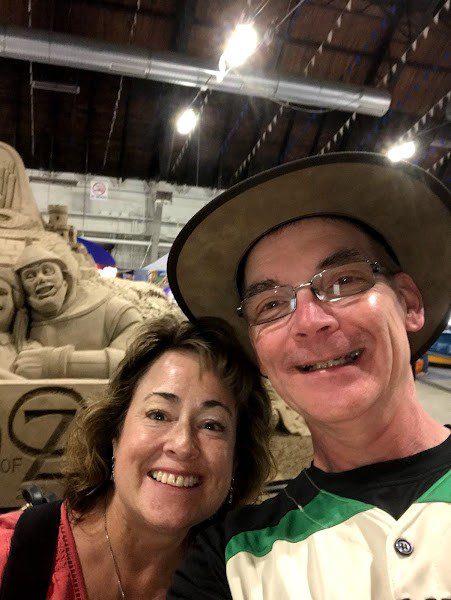

For over 35 years, Chuck and Cindy have explored the USA’s diverse landscapes, from majestic mountains to serene coastlines. Their extensive experience with tent camping, trailers, and RVs allows them to share valuable insights and tips to help you navigate the world of free RV camping.

Unleash Your RV Adventure: A Land of Endless Exploration Awaits

The United States boasts a treasure trove of public and private lands perfect for RV Camping. Explore the majestic landscapes and diverse ecosystems across::

National Forests

National Parks

Private Campgrounds

State Parks

Responsible Camping

Responsible camping and preserving nature are crucial aspects of enjoying the great outdoors while ensuring that our natural resources remain undisturbed for future generations. By adhering to the principles of Leave No Trace camping, individuals can minimize their impact on the environment, protect wildlife, and preserve the beauty of our national parks and other outdoor spaces. Simple practices such as disposing of waste properly, leaving what you find, and respecting wildlife contribute significantly to the conservation of these pristine areas. The National Park Service and the Leave No Trace Center for Outdoor Ethics provide comprehensive guidelines and resources for responsible outdoor recreation. By educating ourselves and practicing responsible camping, we can all play a part in safeguarding our planet’s invaluable natural wonders.

For more information, visit:

-

National Park Service: https://www.nps.gov/subjects/camping/camp-responsibly.htm

-

Leave No Trace Center for Outdoor Ethics: https://lnt.org/

Recent Posts

A 35+ Year RVer’s Guide to Finding Free & Cheap Campsites

By Chuck and Cindy Price | RV travelers since 1990 Quick Answer: How We Actually Find Free &...

Top 10 Accessible Boondocking Spots (No Hiking Required)

Accessible boondocking is a breakout trend for 2026, with search volume increasing by 25% as the...

Wildlife Safety Tips for Boondocking: Staying Safe and Aware in the Great Outdoors

The 3-Zone Wildlife Safety System: A Boondocker's Guide One of the greatest rewards of RV...

The Ultimate Guide to Stealth Camping: Camp Free in Your RV

Unleash the freedom of camping virtually anywhere! Stealth camping allows you to explore hidden gems and boondock locations off the beaten path. But is it legal and safe? Discover the secrets to stealth camping responsibly and comfortably with our ultimate boondocking guide.

Free RV Camping Gems

Explore America’s most Breathtaking Boondocking Destinations

Umpqua National Forest

Moon Falls

Pothole Point Trailhead

Canyonlands National Park

Honest RV Campground Reviews

Unbiased and REAL Reviews of our stays, penned by Cindy & Chuck, offer authentic insights into diverse camping experiences, drawing from our extensive adventures in the great outdoors. To ensure a comprehensive evaluation, we take into account factors such as location, amenities, cleanliness, and overall experience. Furthermore, we cross-reference our observations with external sources, including official campground websites and user reviews from reputable platforms, to guarantee the utmost accuracy and reliability of our reviews.

Free RV Camping Adventures: The Magic of Boondocking

Craving adventure and seclusion? Embrace the freedom of boondocking! Explore vast landscapes, witness breathtaking sunrises, and experience the serenity of nature. The United States offers a wealth of boondocking opportunities on public lands managed by the BLM and National Forest Service. Imagine stargazing under a blanket of stars or waking up to the call of wild birds. Boondocking isn’t just about saving money, it’s about connecting with nature on a deeper level.

For more information, visit:

- Bureau of Land Management: https://www.blm.gov/programs/recreation/camping

- US Forest Service: https://www.fs.usda.gov/visit/know-before-you-go/boondocking

Travel Gallery

Some of our favorite photos